Who can avail Tax Benefits u/s 80D

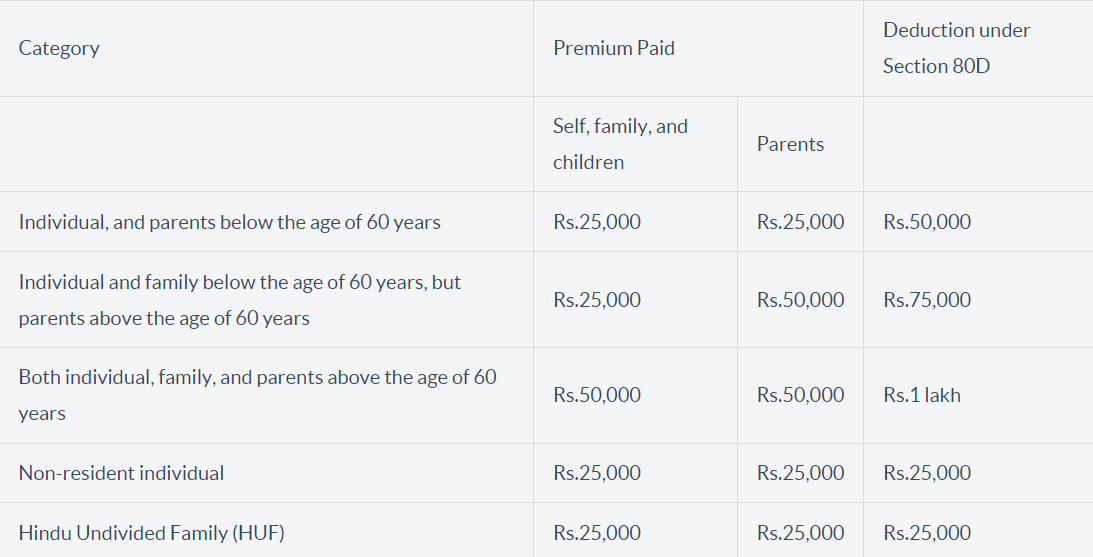

- A person can save tax up to Rs. 25,000 u/s 80 for his own premium or premium paid for his family which includes Self, Spouse and dependant children, generally up to the age of 25 years.

- A person can take an additional tax rebate up to Rs. 50,000 for his/her Dependant parents. The eligibility criteria to claim Rs. 50,000 for dependant parents, one or both parents should be a senior citizen means has completed the age of 60 years. In case, the dependant parent is less than 60 years. Only a 25,000 rebate is eligible.

- In case a senior citizen becomes the proposer and buys a policy for himself. He/she is eligible for a tax rebate of Rs. 50,000

- The situation where the child comes to the proposer and he is a senior citizen and taking policy for his parents also. In that, both are eligible for Rs. 50,000 + Rs. 50,000 rebate.

- For HUF (Hindu Undivided Family). Self and dependant parents can take rebates up to 25,000 + 25,000 only

So, basically, a person can take a Tax Rebate up to Rs. 75,000 in a financial year for the base premiums paid for health insurance for himself/herself, family and dependant parents.

FAQ’s for Tax Rebate under section 8D

Q1. Is cash Premium Eligible for Tax Rebate Deduction?

A. No, If you paid your premium in cash. You are not eligible to take a Tax Rebate. You can pay online or thru your own cheque.

Q2. Total Premium is eligible for Tax Deduction?

A. No, only the base premium which you paid for premium excluding tax.

Q3. What is the difference between 80C and 80D?

A. Tax Rebate of u/s 80D is for medical and Mediclaim Premiums. To take tax rebate u/s 80C you can invest in LIC or any other life insurance, PPF (15 Years Lock-in), ELSS Mutual Funds (3 years Lock-in), Bank FD (5 Years Lock-in) etc.